“We can’t put a store there. It won’t perform well because of proximity.”

“That site is within three miles of another one of our restaurants. We’ll need to find a location that’s farther out.”

Sound familiar? These are the general rules and policies that many brick-and-mortar companies live by. Their purpose is to minimize cannibalization and sales transfer. Before GPS trip data was available it was the easiest way to safeguard against the potential impact of new sites located in the same markets as existing stores.

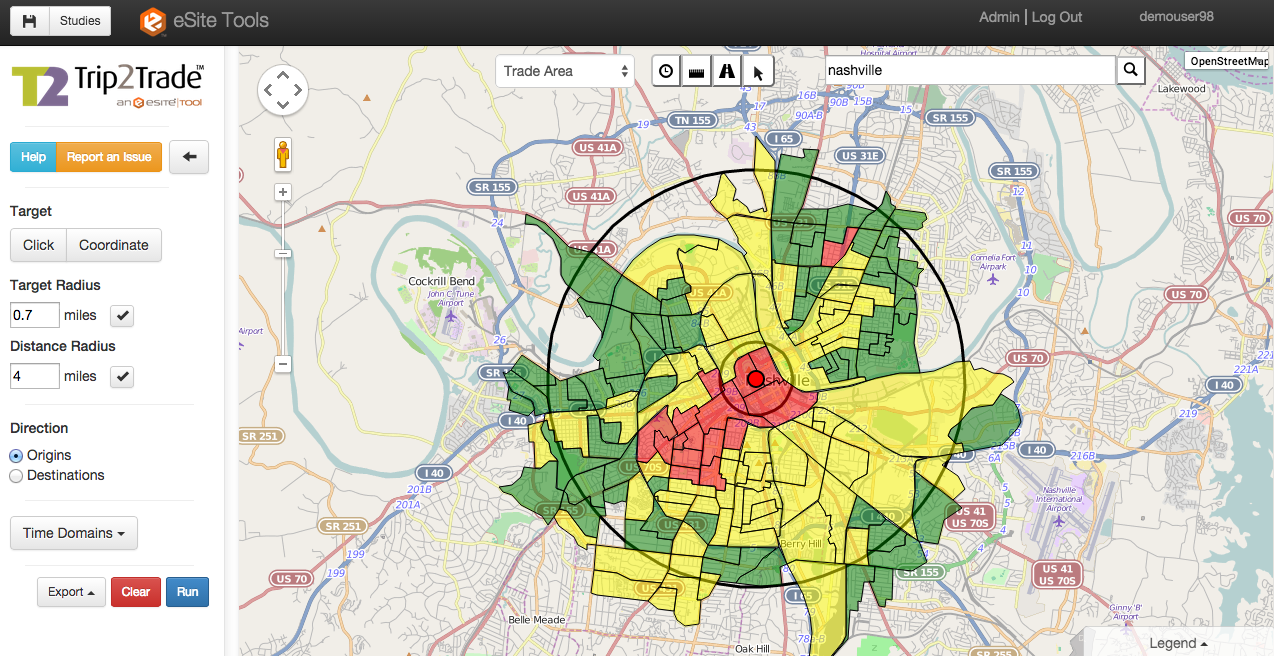

Today, real estate teams have a data-based method for determining how closely stores can be placed to each other without risking financial losses. Many spatial analytics tools will let you see where people are coming from and going to so you can get a crystal clear understanding of both new and existing customers and their shopping habits in any market.

At eSite, analysts see this play out in many site selection decisions. Geographic barriers, commuting patterns and seasonal tourism can all impact how people shop. As it turns out, it’s often not the way seasoned real estate analysts would predict.

What GPS Trip Data Reveals About Sales Transfer

Edible Arrangements

Consider Edible Arrangements—the international chain that sells fresh fruit gift baskets. For years, the company followed a general policy that no two stores could be located within five miles of each other. The assumption was that the new location would simply draw current customers away from an existing one, instead of attracting a new set of shoppers.

With eSite Tools™, the brand is identifying locations that not only break this rule, but also promise high returns on investment by maximizing opportunities in underserved markets.

Buffalo Wild Wings

For years, Consolidated Wings Investment (the company behind a group of Buffalo Wild Wings franchises) was relying on standard distances and drive times to forecast cannibalization. But these methods don’t really reflect the true habits of consumers in the brand’s trade areas.

By adding GPS data to the mix, the company’s analysts are now able to be much more flexible with site selection. They’re also using the data to create more sophisticated and highly targeted marketing plans. (When you know where people are coming from, and not just how close their homes are to a restaurant, direct mail spends get a much bigger return.)

Zoe’s Kitchen

The company’s decision makers had been advised that sales transfer would keep stores in certain locations from performing well. Then they started using a GPS-powered analytics tool to study trade areas, and that assumption changed. As one spatial analyst put it:

“Conversations suddenly went from ‘that location won’t work’ to ‘heck ya we can put a store there.’”

At the end of the day, adding GPS trip data to your studies will make it clear exactly how new stores will impact your existing network. The answers are likely to surprise you and your brand may have the potential to be bigger than you ever thought possible.